The proposed rule was introduced by the comptroller of the Office of the Comptroller of the Currency, Brian Brooks, last Friday and is now open to the public until January 4 for viewing and commenting. The rule aims to prevent banks from the possibility to refuse to finance projects “except to the extent justified by such person’s quantified and documented failure to meet quantitative, impartial risk-based standards established in advance by the covered bank. The covered bank’s decision to deny one of these services to a person could not include consideration of the bank’s opinion (or the opinion of its employees or customers) of the person, the person’s legal business endeavors, or any lawful activity in which the person is engaging or has engaged.» as stated in the proposed text of the law. This would force banks to grant lending to projects that are financially safe but not necessarily sustainable. In fact, it is a compulsion for a bank to act contrary to its sustainability standards.

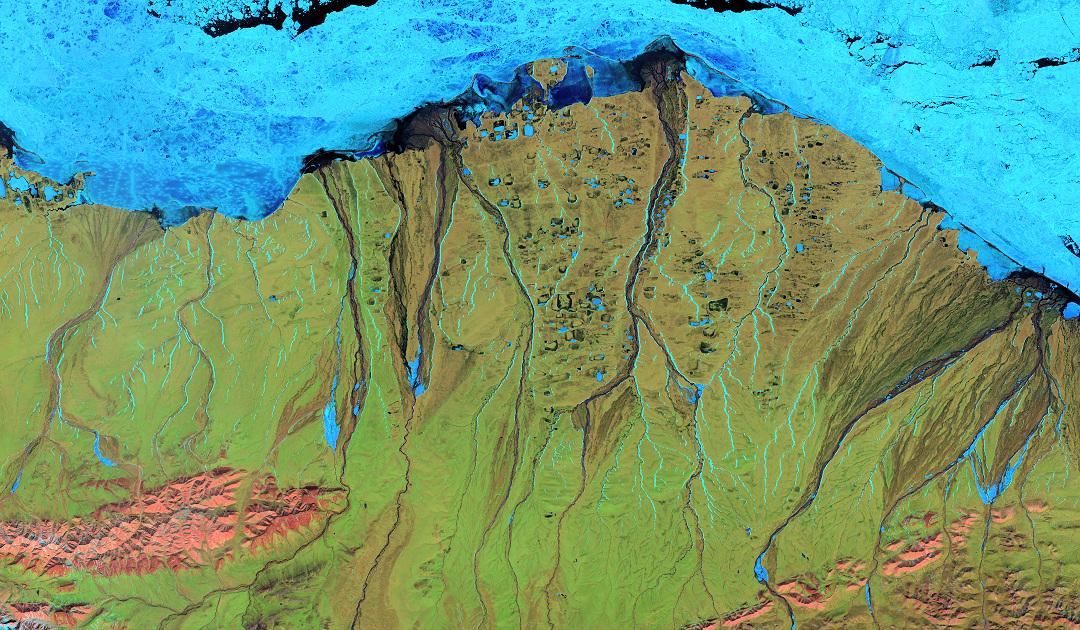

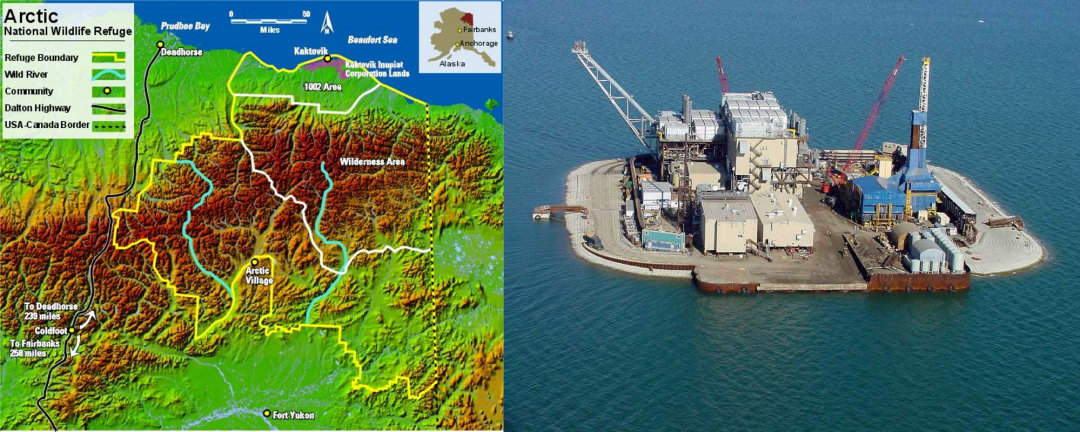

The whole situation was spurred on by a letter that Alaskan Republican members of the Senate and House of Representatives had written to the Comptroller Office and other agencies in June. In the letter, they complained about the decision of several major banks not to finance the extractions projects in the North Slope area of Alaska. According to their view, the decisions were made unfairly and unlawfully and constitute discrimination against those First Nations groups that are in favour of extraction projects and are endangered in their future and livelihoods.by these decisions. Brooks said at the presentation of the rule proposal that the agency had not investigated the discrimination allegations, but had discovered in the course of the analysis that the banks had rejected not only the oil projects, but also coal mining and weapons production projects, as Arctic Today writes.

However, whether the law will be of long-lasting and will have a major influence on the decisions of the banks at all is yet to be seen. For one thing, it must be pressed through in a kind of “last minute” regulation in order to enter into force during Yet-President Trump’s term of office. And President-elect Joe Biden has announced already that from Day 0 of his presidency, i.e. from January 20, many decisions of the current administration will be put to the test and, if necessary, reversed. The granting of drilling rights in the ANWR is definitely one of them. Protecting this Arctic region was a campaign pledge and a matter of the heart for both Joe Biden and Kamala Harris. On the other hand, banks still have the opportunity to use the rule to their advantage and to show that their decisions were based primarily on financial considerations and on risk assessments and not on political or social factors. In addition, the rule only applies to large US banks with assets of more than USD 100 billion.

Dr Michael Wenger, PolarJournal

More on the subject: